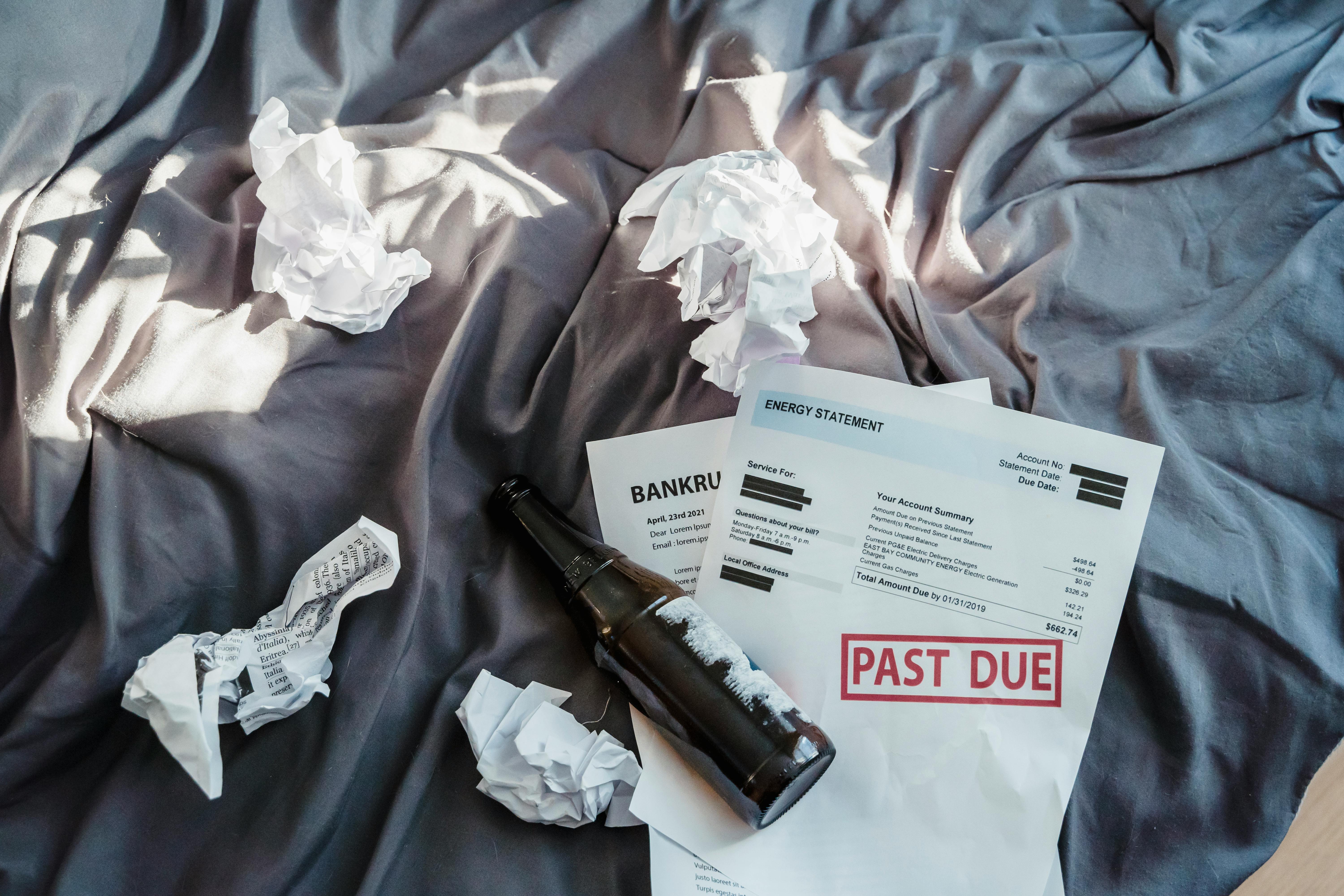

In response to the rising cost-of-living crisis, the Chancellor of the Exchequer announced significant reforms to Universal Credit, targeting those struggling financially. Effective immediately, nearly one million households will see an average 420 improvement in their benefits, thanks to a revised Fair Repayment Rate. This change aims to alleviate financial burdens and provide stability to low-income individuals and families, ensuring they can manage debts and everyday expenses without undue hardship. The implementation of these measures marks a pivotal step toward addressing the urgent issues faced by citizens during these challenging times.

The announcement of a significant boost to Universal Credit, specifically a 420 increase in benefits payments starting from today, marks a pivotal moment in the ongoing battle against rising debt burdens among low-income households. This reform represents a substantial shift in how benefits are managed and distributed, aiming to alleviate the financial strain faced by thousands of individuals grappling with mounting debts.

In recent years, the scale of Universal Credit claims has surged, with nearly 1.2 million households experiencing deductions totaling over £420 per year due to unpaid debts such as benefit overpayments and rent arrears. This trend underscores the urgent need for targeted measures to prevent further hardship and ensure that these vulnerable populations can maintain their basic needs during challenging economic times.

By implementing the Fair Repayment Rate, Chancellor of the Exchequer Rachel Reeves aims to streamline the process of debt repayment, particularly focusing on universal applications. This initiative reduces the maximum deduction from 25 percent to 15 percent, enabling claimants to retain a greater proportion of their benefits while ensuring that overdue debts are addressed responsibly. This adjustment promises to offer immediate relief to those who face the brunt of debt, thereby enhancing their ability to meet daily expenses and manage financial responsibilities effectively.

This move aligns closely with broader government initiatives aimed at improving social mobility and combating the cost-of-living crisis. By providing a more equitable distribution of resources, policymakers seek to empower low-income households to navigate the complexities of modern finance more confidently. The implementation of the Fair Repayment Rate demonstrates a commitment to creating pathways out of debt and fostering economic stability, particularly for those most affected by the current economic landscape.

Moreover, this reform intersects with other national strategies, such as the Get Britain Working White Paper, which focuses on job creation and improved access to opportunities for young people. By addressing the root causes of debt accumulation and promoting sustainable borrowing practices, the government aims to build a resilient economy capable of supporting diverse segments of society.

It is worth noting that similar reforms have been implemented elsewhere, highlighting the global nature of this issue. Countries like Canada and Australia have similarly adjusted their social safety nets to provide greater financial support to citizens facing overwhelming debt burdens. These international comparisons underscore the urgency of adopting comprehensive approaches to mitigate the impact of debt on individuals and communities.

In conclusion, the introduction of a 420 increase in benefits payments under the Fair Repayment Rate signifies a critical step forward in the fight against escalating debt. By targeting specific demographics and adjusting the repayment mechanisms, this reform addresses the pressing needs of low-income households directly. As the

Universal Credit Boost: An Analysis of Policy Implications

Universal Credit Claimants Receive Significant Financial Relief

Chancellor of the Exchequer Rachel Reeves announced significant reforms to the Universal Credit scheme, impacting nearly 1.2 million households across the United Kingdom. According to her statement, starting from today, 1.2 million households will enjoy an average 420 better-offment compared to previous years.

Reforms include lowering the Fair Repayment Rate, which limits the percentage of benefits that can be deducted to repay debts. Previously, deductions could reach up to 25%, but now they are capped at 15% for most cases. Exceptions exist for fraudulent activities or sanctions.

This change aims to provide relief to struggling households, particularly those affected by the rising cost of living. The move is intended to make borrowing more sustainable and to prevent further hardship among vulnerable populations.

Personal Impact and Real-World Examples

Rachel Reeves highlighted the impact on various stakeholders:

Individuals: Many universal credit claimants face financial struggles due to high debt levels. With the new rules, they expect to see an average 420 improvement in their benefits.

Jobcentres: Local authorities and job centers play a crucial role in supporting these households. Ensuring that resources are allocated effectively during this period is critical.

Consumer Credit & Collections News: Reports indicate that many consumers are finding it increasingly difficult to manage their finances amid rising inflation. The new regulations aim to alleviate some of these pressures.

Long-Term Economic Implications

While immediate improvements are evident, experts caution against overlooking potential longer-term effects. Some argue that reduced spending might lead to decreased demand in certain sectors, affecting overall economic stability.

However, there are also optimistic views that this initiative signals a commitment to addressing systemic issues plaguing the welfare system. By improving transparency and fairness in debt management, the government hopes to foster greater trust between citizens and the state.

Geographical Relevance

The reforms have wide-ranging impacts across different regions of the UK. In England, the scale of the change is vast, underscoring the importance of targeted interventions tailored to specific areas experiencing heightened financial stress.

In Turn2us, the organization emphasized the urgency of implementing these measures, stating that they aim to provide a safety net for those most vulnerable to the consequences of the current economic climate.

Conclusion

The introduction of the 420 Universal Credit boost represents a pivotal moment in the ongoing battle against

In light of these developments, the immediate impact of the 420 boost in universal credit benefits is anticipated to significantly alleviate the financial strain faced by millions of claimants. With the introduction of the Fair Repayment Rate, the maximum deductions from Universal Credit payments have been reduced to 15 percent, thereby allowing more households to retain their full entitlements. This move aims to provide greater financial stability and flexibility for those struggling to meet their daily needs while repaying debts.

Looking ahead, there are several significant events and dates that warrant attention:

March 2025: The UK is expected to celebrate the end of winter and spring, marking the transition to warmer weather and potentially easing some of the economic pressures brought about by the ongoing cost-of-living crisis. During this period, it would be prudent for policymakers to review and adjust further measures to ensure continued support for vulnerable populations.

April 30, 2025: A pivotal date in the implementation timeline, as mentioned earlier, this marks the beginning of the new fiscal year and the commencement of the revised rules affecting Universal Credit beneficiaries. Given the comprehensive nature of these reforms, stakeholders should prepare for potential adjustments to benefit delivery systems and administrative processes.

September 2025: With the onset of autumn, the focus shifts to ensuring that seasonal challenges, such as rising energy prices and increased food costs, do not disproportionately affect low-income households. This period presents an opportunity for targeted interventions and initiatives to mitigate the adverse effects of these factors on vulnerable communities.

December 2025: Towards the end of the calendar year, there might be opportunities for finalizing the roll-out of new policies and programs aimed at enhancing financial resilience among citizens. This could include supplementary welfare schemes, educational initiatives, and social welfare programs tailored specifically to support disadvantaged groups during challenging times.

By staying informed and adaptable to evolving conditions, both government officials and non-governmental organizations can effectively navigate the complexities presented by these changes, ensuring that universal credit continues to serve as a reliable lifeline for those in need.

This forward-looking conclusion ties back to the primary keyword 'universal credit 420 boost,' emphasizing the tangible benefits expected to result from recent policy adjustments. The inclusion of specific dates and seasons provides context for understanding when particular aspects of these reforms will come into play, making the content more relatable and actionable for readers.